A stock split, also known as a stock price split, increases the number of shares outstanding that a company has and lowers its stock price, which makes it more affordable for the average investor.

If you own one share of Amazon, you’ll end up with 20 shares after the split, which will cost about the same as the previous price. The value of your investment doesn’t change, and one Amazon share that was traded for $2,450 would become 20 shares that cost a little more than $120.

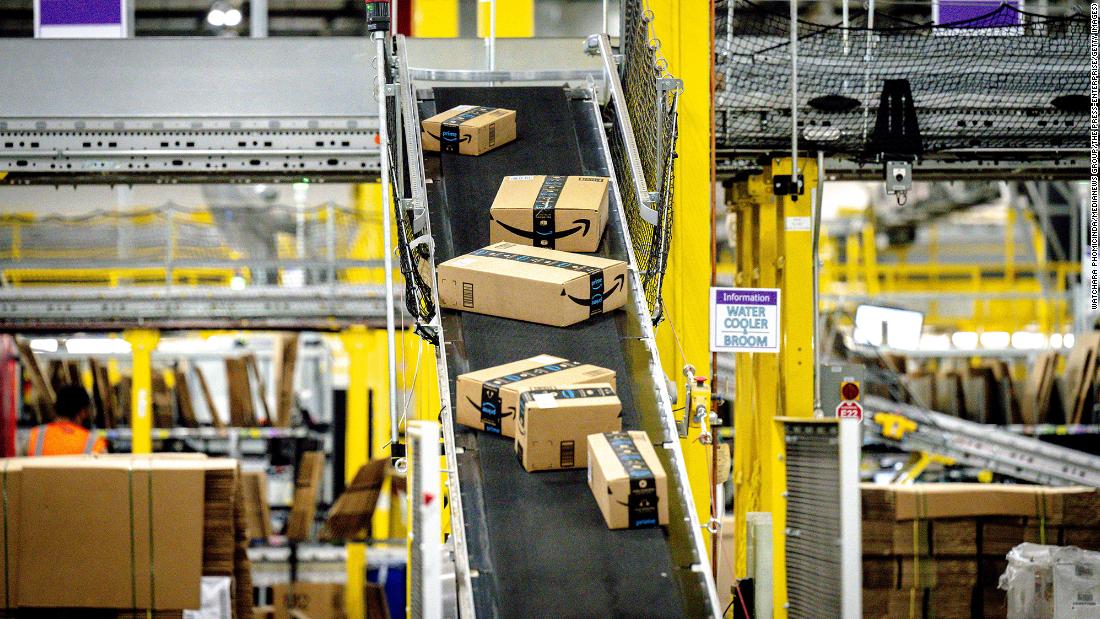

Why is this happening to Amazon now? Companies with high stock prices announce splits in order to make their shares more affordable for retail investors. The 20-1 split that will occur in July was approved by the board of directors of the company, which trades at a price of more than $2,300 and has a market cap of over $1 trillion.

There is a 10-for-1 stock split planned for later in June by online retailer Shopify, as well as a proposal by meme stock darling GameStop to split its stock as well.

Even though a stock split may make it seem like a share is now more affordable, it doesn’t make the stock any cheaper when looking at valuation measures.

After the split, Amazon will be worth more than $1 trillion. The stock will be trading for more than 150 times earnings forecasts for this year and 2.5 times projected sales, which is significantly higher than the broader stock market and other retail industry leaders.

Many individual investors were forced to buy fractional shares or exposure to the companies through popular exchange-traded funds if they wanted to own growth stocks like Amazon.

Making the share prices of quadruple-digit stocks more accessible is a smart move according to Michael Mullaney, director of global markets research for Boston Partners. More investors should be able to buy round lots instead of just a few shares.

Over the past year and a half, retail investor trading has increased dramatically and has become important again. “It’s not limited to big institutions and hedge funds.” It is not possible for an average investor to buy 100 shares of some of these stocks at these prices.

Professional investors are also taking notice. Some traders might be looking to buy before the split takes effect as Amazon’s stock has rallied nearly 6% in the past week. Amazon is down 25% this year.

It’s possible that a stock split for Amazon and Alphabet will increase the chances of them being added to the list.

A group of 30 leading American companies have a weighted price. The daily moves of the index would be affected by the daily share prices of Amazon and Alphabet.

UnitedHealth, which trades for just under $500 a share, has the biggest weight in the DOW, followed by Goldman Sachs and Home Depot, which trade for more than $300 a share.

After a stock split pushed its price from the high triple digits to below $100 a share, Apple’s high stock price was one of the main reasons why it wasn’t added to the index until 2015.

Apple and Microsoft are the only two companies in the US with a higher market value than Amazon and Alphabet, which could pave the way for them to join the Dow.

Big tech stocks aren’t the only ones with inflated prices. Consumers and businesses have been dealing with rising prices of goods and services over the past year. When the US government releases its latest consumer price index figures on Friday, investors will get another look at just how high prices have gone.

Over the past year, prices rose 8.3% It was the first year-over-year drop in consumer inflation since August. In the 12 months that ended in March, consumer prices increased by 8.5%. Over the next few months, economists are hoping that the level of price increases will decrease.

It may take some time for consumer prices to get to a level that is more comfortable for shoppers and the Fed. The Fed would like to see the inflation rate slow to around 3% to 3.5% before declaring victory against inflation.

Ken Shinoda, a portfolio manager with DoubleLine, said the good news is that inflation numbers should start to come down. Will they come down enough to make a difference?

Monday was the day that Amazon split its stock. Apple’s Worldwide Developers Conference is about to start.

Tuesday’s earnings include United Natural Foods, Smucker andCasey’s General.

Campbell Soup, Brown-Forman, Ollie’s Bargain Outlet, and Five Below reported their earnings on Wednesday.

Thursday: European Central Bank meeting on interest rates; US weekly jobless claims; earnings from Signet Jewelers and Stitch Fix.

Friday: Bank of Russia meeting on interest rates.