On Friday, shares of APLE traded down. The company had a trading volume of more than two million shares. The firm has two-hundred day and 50-day simple moving averages. The stock has a 1 year low of $13.83 and a 1 year high of $18.69. The company has a debt-to-equity ratio of 0.49 and a quick ratio of 0.03. The company has a market cap of $3.55 billion, a price to earnings ratio of 43.86, and a beta of 1.06.

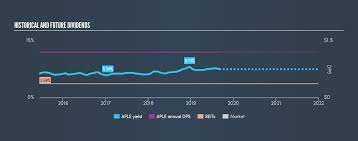

Over the last three years, Apple has decreased its dividends by an average of 67.8% and has increased its dividends every year for the last 1 year. The company’s dividend is sufficiently covered by earnings because it has a dividendPayout ratio of 27.4% The company should be able to cover its annual dividend with an expected futurePayout ratio of 11.9% because analysts expect Apple to earn $1.68 per share next year.

On Thursday, May 5th, the company issued its quarterly earnings results. The real estate investment trust reported $0.09 earnings per share for the quarter, beating analysts’ estimates by $0. There was a net margin of 8.04% and a return on equity of 2.65%. The company posted $0.06 earnings per share in the previous year. According to research analysts, Apple Hospitality REIT will have a earnings per share of 1.47 for the year.

Several hedge funds and other institutional investors have recently made changes to their positions in APLE. State Street Corp increased its holdings in Apple Hospitality REIT during the first quarter. State Street Corp now owns 10,388,765 shares of the real estate investment trust’s stock, which is valued at $186,686,000, after purchasing an additional 1,331,707 shares in the last quarter. During the first quarter, Charles Schwab Investment Management Inc. increased its holdings in Apple Hospitality REIT. The real estate investment trust’s stock is valued at $80,511,000 and the Charles Schwab Investment Management Inc. now owns 4,480,292 shares. During the fourth quarter, Blackrock Inc. increased its holdings in Apple Hospitality REIT. After purchasing an additional 1,040,710 shares in the last quarter, the real estate investment trust’s stock value was increased by $338,726,000. During the first quarter, Centersquare Investment Management lifted its holdings. The real estate investment trust’s stock is valued at $36,450,000, after Centersquare Investment Management purchased an additional 878,930 shares in the last quarter. Goldman Sachs Group Inc. increased its holdings in Apple Hospitality REIT by 61.2% in the first quarter. After purchasing an additional 738,846 shares in the last quarter, Goldman Sachs Group Inc. now owns 1,946,614 shares of the real estate investment trust. The company’s stock is owned byInstitutional investors.

Director Howard E. Woolley bought 1,670 shares of the business’s stock on March 14th. The stock was bought for $29,993.20 at an average price of $17.86 per share. The transaction was disclosed in a legal filing with the SEC. Chairman Knight bought 5,000 shares of the business’s stock in a transaction that took place on Monday, May 16th. The shares were acquired at a price of $16.22 per share. The chairman now directly owns 488,093 shares of the company’s stock, which is valued at approximately $7.916 million. There is a disclosure for this purchase. 6.80% of the company’s stock is held by Insiders.

Apple has been the subject of several analyst reports. In a report on Tuesday, March 1st,Barclays lifted their target price on shares of Apple Hospitality REIT from $19 to $21. In a report on Thursday, April 21st, Oppenheimer began coverage of Apple Hospitality REIT. They gave a rating and a target price on the company. The company’s stock was upgraded from a “hold” rating to a “buy” rating in a report on Tuesday, April 11th. On Thursday, March 31st, Stock News.com initiated coverage on Apple Hospitality REIT. A hold rating was issued for the company. In a report on Thursday, April 7th, TheStreet cut shares of Apple Hospitality REIT from a b- to a c- rating. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating, and three have issued a buy rating to the company’s stock. The stock currently has an average rating of Hold and a consensus target price of $19.75 according to MarketBeat.

The news summary.

A monthly dividend of $0.05 is declared by Apple.

You can find all the latest Security news on this page.