Eli Lilly (LLY) is a stock that is worth watching after it received a bullish analyst note. Electronic Arts took a key benchmark amid takeover rumors.

It’s X.

The volume on the New York Stock Exchange was down. On an up day it is disappointing.

The yield on the benchmark 10-year Treasury note increased. The price of West Texas Intermediate crude was $110 per barrel.

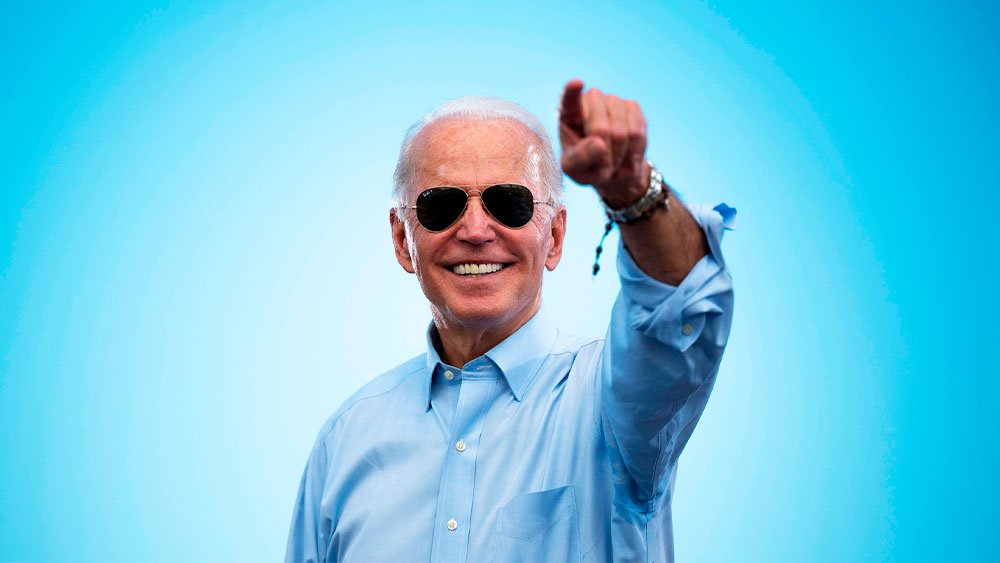

The stock market has been boosted by Biden’s comments about China tariffs.

President Biden said he was considering cutting tariffs on Chinese goods.

I am thinking about it. He said during a news conference that they did not impose any tariffs. They were imposed by the last administration.

Edward said that the accommodative words were great for the market.

He said in a note to clients that the U.S. stock market is rallying because of optimism that President Biden could be positioning for a major de-escalation in the US-China trade war. After eight weeks of selling pressure and a seven-week losing streak for the S&P 500, a rebound was long overdue.

Growth stocks excel, but the stock market gains.

The Nasdaq rose 1.6% despite being behind the other indexes. Palo Alto Networks was up 4.5%.

The S&P 500 was up by 1.9%. Ross Stores, which was badly hit last week, jumped 9.6%.

It’s an index.

It’s a symbol.

It was a price.

Gain or loss.

% Change is not the same.

The name of the company is “Dow Jones.”

There is 0DJIA.

3188.64

The phone number is +618.74

The score is +98.

S&P 500 is a stock market index.

S&P5

3973.85 is a number.

It was +72.49.

There was a score of +86.

There is a stock exchange called the Nasdaq.

It’s (0NDQC )

11535.28 is a number.

+180.64

There was a score of +59.

Russell 2000 was the year.

IWm

178.23 was the final figure.

+2.15 is a new reading.

It was +2.

IBD 50 was published.

It’s called FFTY.

30.56 was the time.

+0.64 is the difference.

There is a +2.14

The S&P sectors were doing well. Financials and energy made the biggest gains.

Small caps made up some ground with the Russell 2000 closing up 1.2%.

Growth stocks did the best. The bellwether for growth stocks, the IBD 50 exchange traded fund (FFTY), jumped 2.1%.

Apple stock was among the best performers.

The major index that was the best was the DJIA. It gained more than 600 points and rose 2%.

Apple was one of the best performers. After falling 6.5% last week, it closed up 4%.

Visa turned in a gain of 4.2%, making it one of the best performers.

JP Morgan Chase leads bank stocks higher.

As the bank stock popped, it was that that led the index. The lift to bank stocks was aided by this.

The firm said that a 17% return on tangible common equity remains the firm’s target and may be achieved sooner than planned.

Jamie Dimon said that there is a good chance of meeting the target in 2022, if the credit environment is benign.

The CFO said earlier this year that the firm would miss its target for the next two years, but this was a different story.

JPM is close to reaching its 50-day moving average. It is still down more than 20% for the year.

Bank of America, Goldman Sachs, Citigroup, and Wells Fargo were among the other bank stocks that rose.

China pulled out of theAirbnb stock market

Despite the reports that it is looking to pull out of China, the stock closed slightly higher.

According to CNBC, the firm is to take down all mainland Chinese listings this summer. An office in China will focus on outbound travel.

The firm launched its mainland China business in 2016 and has faced stiff competition from Chinese businesses. China only accounted for 1% of the company’s revenue despite being the largest market.

After initially falling on the news, the stock of ABNB ended the day moderately positive.

The leader of the stock market was boosted.

When the market is in a correction, it is a good idea to look for bullish moves in stocks.

Eli Lilly is a stock worth adding to your watchlist after it builds a flat base. It is trying to get an entry of 314.10

LLY rose on Monday after the stock was initiated as an outperform by the company. The session ended up with a 1.3% increase.

The potential upside of Lilly’s recently approved obesity drug is not appreciated by the market, according to SVB. The stock is trading above its moving averages and is bucking market weakness.

Electronic Arts stock shot up on reports of a possible sale. It closed with a gain.

The likes of Disney, Amazon.com and Apple are said to have held talks with the video game giant.

The 50-day line is higher than the 200 day moving average for the stock. It is not advisable to use this as an aggressive entry given the current tentative state of the market.

The firm is best known for its game franchises such as Madden NFL and Medal of Honor.

If you would like to learn more about growth stocks and analysis, please follow Michael on the social media site.

You might also like it.

Market Smith has everything in one place.

These are the best stocks to buy.

Is this the ultimate Warren Buffett stock?

Software growth stocks should be watched and sold.

Is DWAC the ultimate Donald Trump stock?